Japanese e-Commerce market -How to boost the conversion rate

Japanese consumer behaviour

The Japanese e-Commerce market is different as you might have guessed. Have you ever seen some of those fashion magazines that are stocked at convenience stores in Japan? The selection of magazines at convenience stores is an indication of which magazine has the most circulation in each category. If you have seen those popular fashion magazines, you’ll notice the difference between those in the UK or the US. The contents in Japan are more like a catalogue with many products and information on one page. Japanese consumers are used to product overload and text-rich information and they trust a product the more details there are. In other words, the more information the more sales.

The challenge of converting visitors to customers on e-Commerce

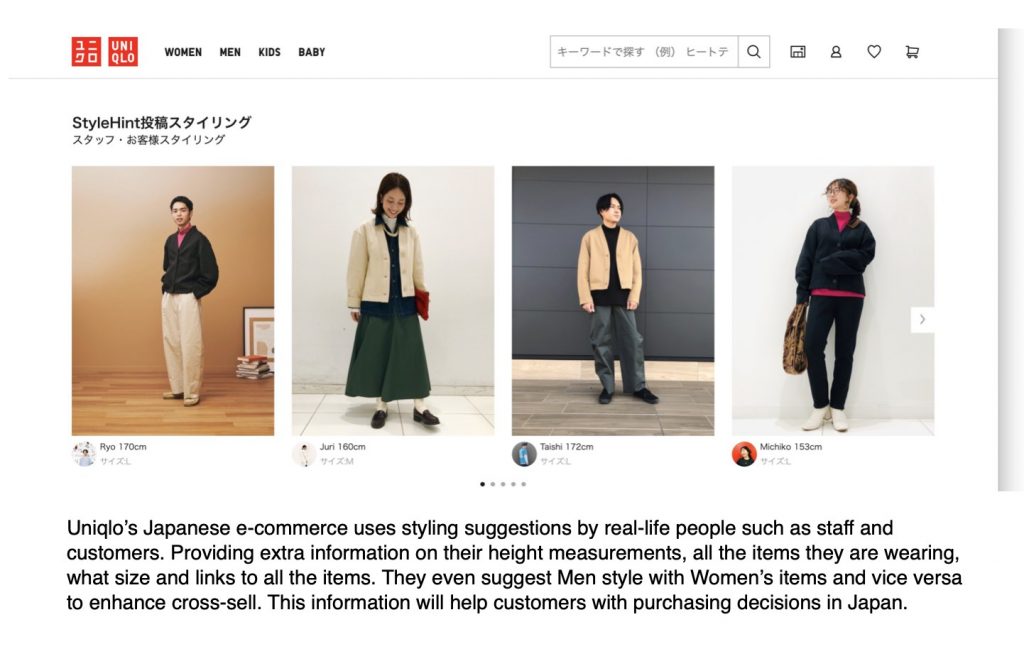

Unless your brand is already established, Japanese consumers are much more likely to trust real people rather than paid ads that come up on the feed of social media platforms. It is for this reason that Japanese consumers trust shop assistants who can give advice to them more. Similarly, brands are using ambassadors and influencers to grow audiences. However, an issue is that when customers visit an e-commerce shop, usually there’s no one to answer some less obvious questions on the spot. Also, the images are limited and often difficult to imagine the product on them or in their lifestyle.

Boost the conversion rate in the Japanese e-Commerce market

In early on, successful Japanese e-Commerce retailers such as Adastria and Baycrews realised it’s important to focus on converting visitors to customers and not so much on growing audiences. Vanish Standard who created Staff Start, an e-Commerce application, realised shop staff can address this issue both online and offline. Their innovative app has been helping over 1,600 brands including fashion, cosmetics and wines, and increased sales by almost 3-fold in 2020 alone.

The eCommerce market in Japan 2020, Data, Trend

Their unique system enables shop staff to become influencers and they can earn incentives by selling the products on their website or social media platforms. The app displays the sales results among staff and motivates them by showing how well they are doing. A top shop staff recorded sales of 90million yen a month. Baycrews reported in January 2021, 70% of total online sales of 4.6 billion yen came via the Staff Start app and it’s growing.

In the same way, Channel talk provides a chat system service and businesses can manage all the chats between the shop staff, customers from e-commerce sites and official LINE account on one platform. By deploying this communication system, they’ve helped to not only increase sales conversion by 70% but also enabled upsell & cross-sell on e-commerce. They believe the answer is in close interaction with customers to convert them into loyal customers.

Employee to consumer

This approach of linking shop staff to customers via technology is fundamental to how Japanese businesses are already moving onto the next stage of unifying online and offline to create a real omnichannel business with multiple touchpoints. They call this seamless business model – Employee To Consumer, E2C in Japan.

Identifying a person’s trigger motivation is key to persuasion. Have you thought about this marketing approach for your business? Do you want to find out more about the Japanese e-Commerce market? Please get in touch if you have any questions.

Resources

WWD Japan

What is the biggest Social media platform in Japan?

What is LINE? The biggest social media platform in Japan is LINE with over 95 million active users and counting. I get this question from many companies, but the platform is unfamiliar to them and often overwhelmed by the idea. If this issue resonates with you, read on. One such platform that has gained immense…

How to expand DTC business in Japan with localised marketing

Localised marketing Localised marketing is a way to build trust with customers, but it also has the added benefit of helping you gain more conversions and sales. By localising your marketing efforts, you can make sure that your marketing copy is targeted directly at Japanese customers. This means that instead of relying on a translator…

Live commerce in Japan – transforming online shopping

How social media changed consumer behaviour As Japanese consumers are shifting their way of shopping to digital, many experts predict this will remain after the pandemic. Before social media, It was unavoidable for companies and brands to sell their products through established shopping malls and invest in expensive adverts to promote their products. Nevertheless, the…

IKEA Japan – the key to attracting Japanese consumers

IKEA’s failure Did you know IKEA Japan failed to enter the Japanese market in the ‘80s? When they entered the Japanese market in 1974, IKEA partnered with Mitsui Bussan (Trading company) and Tokyu department store. They had 2 small stores but this meant fewer products with variations that suit Japanese homes and lifestyles. The lack…

Booming home decoration market in Japan

A surge in DIY home renovation and interior decoration During the pandemic, people have changed their lifestyles. Consequently, they invested their free time and money on home improvement as their home time increased. Alongside online and printed media for affluent city dwellers, YouTube tutorials and Instagram pushing the trend, there is a surge in DIY…

Popular British brands in Japan

Can you name any popular British brands in Japan? Are they the same as in the UK? As you know Japanese are well known for always seeking out the most niche and high-quality things. Japanese are fond of anything with quality and heritage. Any brand holding a Royal warrant will have an advantage as it…