DTC in Japan – 5 things you should know before investing in Direct-to-consumer

Direct-to-consumer (DTC/D2C) has simplified Japan market entry without relying on traditional wholesalers or third-party retailers. It means it’s easier to sell to Japanese consumers directly and expand your brand into the Japanese market. The e-commerce market has been steadily growing and the pandemic has accelerated the number of online shopping users in Japan and that growth is set to continue. While the Japanese e-commerce market is enticing, here are 5 things that will make it understand and deal with.

1. Japanese e-commerce Market size and the rise of DTC

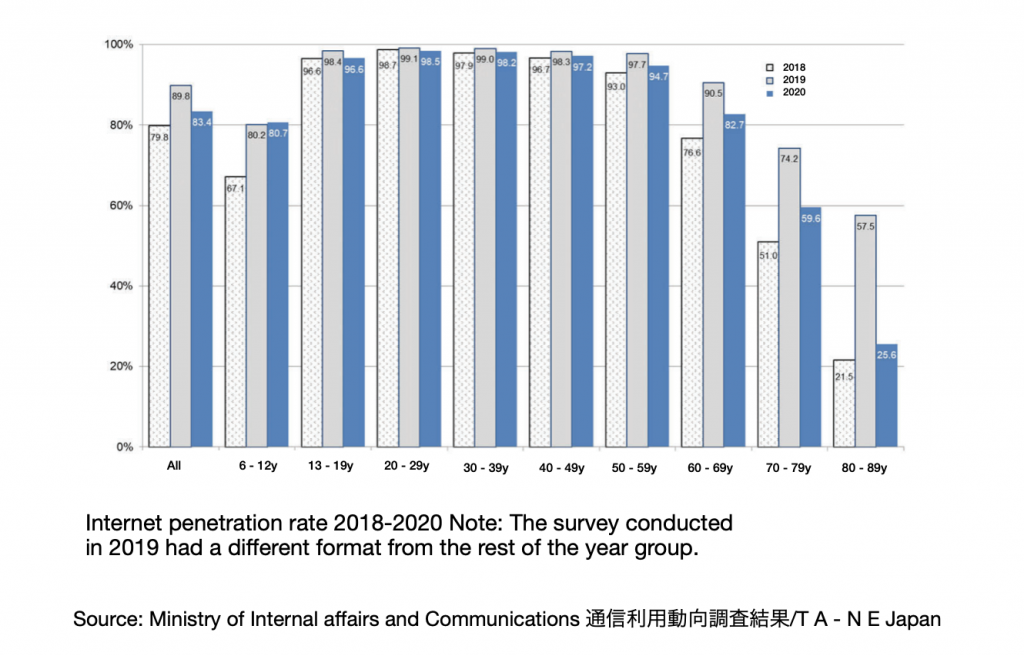

Japanese are latecomers to the online shopping world as they enjoy in-store shopping experiences and shops are easy to access, thus resulting in a slow start in the share of e-commerce retail sales. Another key point is that cross-border sales are low as most Japanese consumers don’t read English and only buy from Japanese language websites. Nevertheless, Japan is the fourth largest e-commerce market in the world. Additionally, a recent survey reported a 21% increase in e-commerce (goods sales) year-on-year in Japan. Moreover, JapanConsuming reports that the apparel wholesale market has shrunk dramatically in the last decades as vertically integrated retailers take more share. This means DTC is expanding in the retail market. In summary, with a population of 126.3 million, over 90% internet penetration rate between 13 – 59 years old, and 52.1% of those making online purchases, Japan is one of the major markets for brands to focus on investing in DTC.

2. Is it better to use marketplace / online malls in Japan?

The top online malls in Japan are Amazon, Rakuten, Yahoo! Japan and ZOZO Town. Together, they share more than 50% of the e-commerce market. Rakuten is similar to Amazon and the platform is for general merchandise. While Yahoo! Japan has its subcategories targeting different demographics. ZOZO Town only sells fashion and accessories at a cheap price point as the main users are in their 20s. However, a new luxury fashion category, ZOZO VILLA has attracted many luxury brands amid the pandemic. These platforms are good to utilise for innovative products with lots of information such as gadgets and healthcare products as Japanese consumers trust them. Also, they are a popular choice for affiliate programs and it will raise PR opportunities. However, these platforms are overcrowded and it would be difficult to showcase the brand image to build the brand. Therefore, brand-oriented businesses should strengthen their digital marketing to drive customers to their website and take advantage of the online malls if they need to reach a younger market such as ZOZO.

3. Growing mobile commerce market

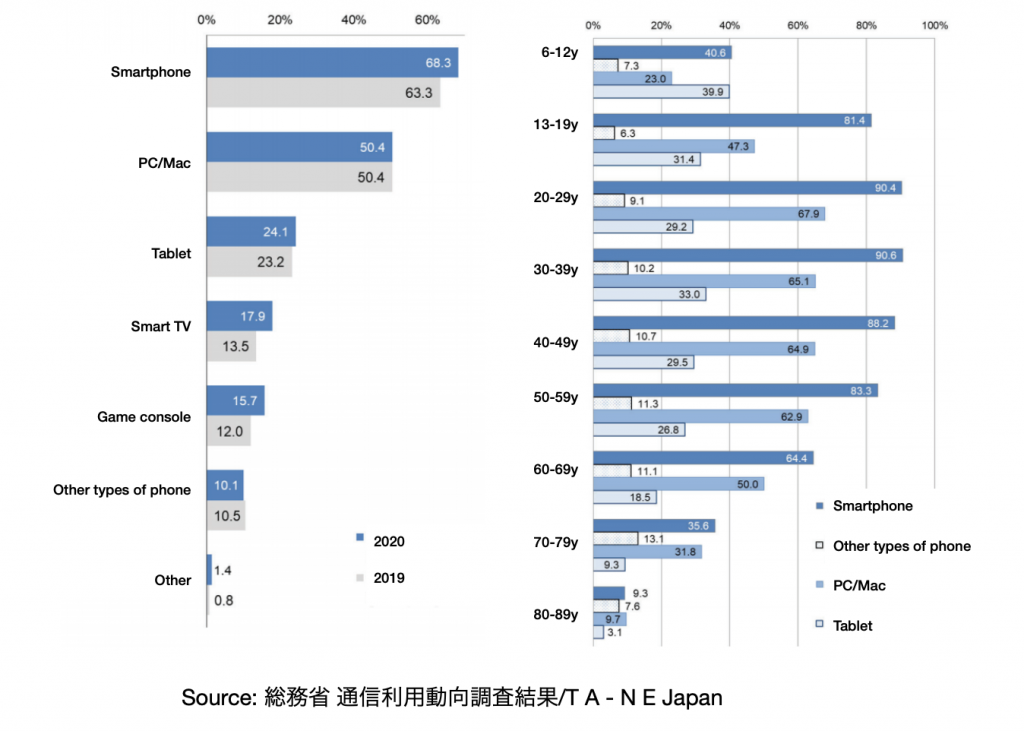

Japan is the leading country of m-commerce (mobile commerce ) which is the future of e-commerce. A Ministry of Internal affairs and communications report explains that smartphone users now account for 86.8% of all mobile users with over 90% internet penetration rate (13-59 years old). Since Japan is equipped with extensive numbers of phone masts throughout underground train tunnels, fast and strong wifi is available everywhere on the train (unlike the UK). Equally important to mention, it is taboo to talk on the phone while on trains in Japan. As a result, commuting time becomes online shopping time.

4. Import duty in Japan

In comparison to other countries, Japan is more relaxed on Import duties and taxes for non-commercial goods. It allows Japanese customers to import goods without paying any duties or taxes if the value of the goods is lower than ¥16,666 (This doesn’t apply to leather bags, knitwear, shoes, gloves, etc,). For instance, customers can buy directly from the UK up to the product value of around £100 without worrying about any additional payment on arrival. It is a huge advantage for online retailers to promote their products and retain them to become repeat customers. To optimise sales, the overseas DTC brands can increase their retail price and offer free shipping.

The eCommerce market in Japan 2020, Data, Trend

5. How DTC brands can optimise sales in Japan

The benefits of the D2C model in reducing costs by cutting out middlemen are clear and businesses can also test the market before investing heavily. Nevertheless, investing in localised marketing and PR to drive customers to your website and build your brand is a necessity for a DTC brand. For example, creating a localised website that appeals to both brand ethos and the Japanese market is important. Note: When you localise your website it doesn’t simply mean just to translate your website into Japanese. Next, raise awareness of your product through localised PR. The effect of recommendations from reputable or trusted media titles is more powerful than paid ads and it will transform a reader into a buyer quicker. Utilising dedicated Japanese social media for promotions and Influencer marketing is key. The advantages of Influencer marketing are measurable and will enhance your brand position and popularity. Now that people can purchase items through social media (“social shopping”), it is essential to expand social channels to have better engagement with customers. On the whole, Japanese consumers value recommendations and customer reviews when it comes to online shopping. It’s vital to present this facility on all platforms. Lastly, the Japanese are used to high-level customer service and they expect that for online shopping. Western companies are doing fine, but the customers are indeed treated like gods in Japan compared to some western markets. Companies go above and beyond to appeal to their customers’ hearts, which applies to DTC brands too.

The points I’ve explained are all important for DTC brands to successfully enter the Japanese market. Are you already in Japan, but need help in localised marketing and PR? Are you thinking of market expansion into Japan and need help? Or, would you like to get some ideas on how to treat Japanese customers like gods? Just drop us an email! T A – N E can help you with any advice or tips.

Resources

Top 10 Countries, Ranked by Retail Ecommerce Sales, 2020 & 2021 (billions and % change)

Ministry of Economy, Trade and Industry 2021 EC survey

Ministry of Internal affairs and communications

https://www.customs.go.jp/tsukan/kanizeiritsu.htm

What is the biggest Social media platform in Japan?

What is LINE? The biggest social media platform in Japan is LINE with over 95 million active users and counting. I get this question from many companies, but the platform is unfamiliar to them and often overwhelmed by the idea. If this issue resonates with you, read on. One such platform that has gained immense…

How to expand DTC business in Japan with localised marketing

Localised marketing Localised marketing is a way to build trust with customers, but it also has the added benefit of helping you gain more conversions and sales. By localising your marketing efforts, you can make sure that your marketing copy is targeted directly at Japanese customers. This means that instead of relying on a translator…

Live commerce in Japan – transforming online shopping

How social media changed consumer behaviour As Japanese consumers are shifting their way of shopping to digital, many experts predict this will remain after the pandemic. Before social media, It was unavoidable for companies and brands to sell their products through established shopping malls and invest in expensive adverts to promote their products. Nevertheless, the…

IKEA Japan – the key to attracting Japanese consumers

IKEA’s failure Did you know IKEA Japan failed to enter the Japanese market in the ‘80s? When they entered the Japanese market in 1974, IKEA partnered with Mitsui Bussan (Trading company) and Tokyu department store. They had 2 small stores but this meant fewer products with variations that suit Japanese homes and lifestyles. The lack…

Booming home decoration market in Japan

A surge in DIY home renovation and interior decoration During the pandemic, people have changed their lifestyles. Consequently, they invested their free time and money on home improvement as their home time increased. Alongside online and printed media for affluent city dwellers, YouTube tutorials and Instagram pushing the trend, there is a surge in DIY…

Popular British brands in Japan

Can you name any popular British brands in Japan? Are they the same as in the UK? As you know Japanese are well known for always seeking out the most niche and high-quality things. Japanese are fond of anything with quality and heritage. Any brand holding a Royal warrant will have an advantage as it…